The Federal Trade Commission has charged that an alleged transnational scam involving student loans has bilked struggling student loan borrowers out of millions of dollars. In response, the operators have agreed to permanently banish themselves from the debt relief business and turn over assets worth more than $1,000,000.

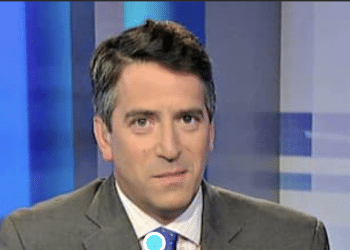

Christopher Mufarrige said, “It’s illegal for debt relief firms to make false claims and to use fake testimonials and reviews to promote their business.” “The FTC won’t hesitate to enforce the laws against bad actors.”

The FTC filed a complaint in July 2024 against two companies: Start Connecting LLC, based in Florida, and Start Connecting SAS, based out of Colombia (doing the business as USA Student Debt Relief), and their owners and operators Douglas Goodman and Doris Gallon Goodman.

- Pretended to be affiliated to the Department of Education or its loan servicers in order to lure student loans borrowers who were seeking debt relief.

- False promises were made about low fixed payments for the rest of your life and loan forgiveness.

- Illegally called tens or thousands of consumers listed on the Do Not Call Registry

- More than $7 million was extracted in advance fees and payments made for nonexistent debt relief services.

- They also posted fake testimonials and reviews on their social media pages and website.

The defendants made false promises that they would apply monthly payments of consumers to their loan balances. In reality, however, the defendants pocketed hard-earned funds from borrowers and sent a large portion to their call center located in Colombia.

In order to settle FTC charges, The proposed order prohibits defendants from:

- Misrepresentation of affiliation with a person, corporation or government entity

- Falsely enrolling consumers into programs that promise permanent low fixed monthly payments, and lump-sum forgiveness of the remaining balance.

- Charges of illegal advance fees to consumers

- Falsely promoting their services online with fake testimonials or reviews;

- Engaging in illegal telemarketing, debt relief and misrepresenting other products and services.

The proposed order imposes also a partially suspended $7.3 million monetary judgment and requires that the settling defendants turn over personal and business assets worth more than $1,000,000. If it is found that any defendant who has settled the case materially misrepresented his or her finances, then the full amount would be due immediately.

The FTC has resources on how to avoid student loan debt relief scams at ftc.gov/StudentLoans. Customers can receive free assistance with student loans at StudentAid.gov.

The Commission approved the final order stipulated by the Commission with a vote of 3-0. The FTC filed its proposed order with the U.S. District Court of the Middle District of Florida. When approved and signed, stipulated final orders become law.

Nathan Nash of the FTC’s Midwest Region and D’Laney Gieselow were the lead staff attorneys in this case.