ATM Alert: ‘Cash Trap’ Scam Leaves Users Empty-Handed — Know the Signs Before You Swipe

Article by Contributor Lisel B

ATM safety isn’t just about skimming anymore—it’s about physical sabotage, international fraud rings, and a public largely unaware of the threat. Cash trapping, a low-tech but highly effective scam, is sweeping across borders with alarming speed, targeting everyday users who assume their machine simply “glitched.” As law enforcement scrambles to keep up, it’s time for consumers to get vigilant and banks to get serious.

In the evolving landscape of financial fraud, a new and insidious technique has emerged that threatens the security of everyday banking: ATM cash trapping. Unlike traditional skimming or card cloning, cash trapping targets the physical cash withdrawal process, deceiving users into believing their transaction has failed while criminals retrieve the trapped money later. This crime, which first gained notoriety in England, has now made its way across the Atlantic and is increasingly being reported in the United States. As law enforcement agencies scramble to respond, the public must be made aware of the deceptive nature of this scam and the steps necessary to protect themselves.

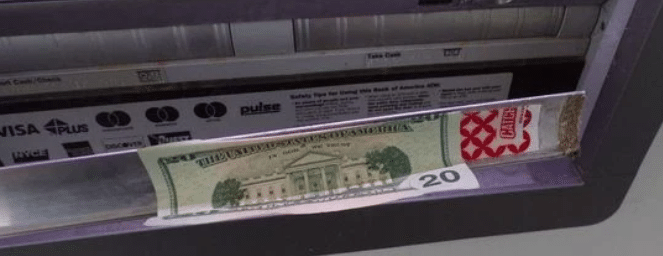

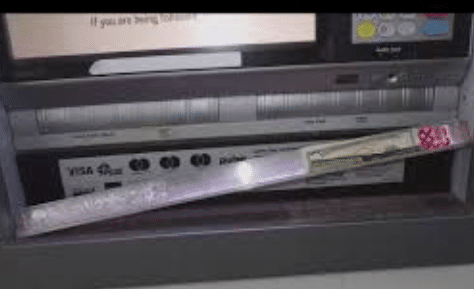

Cash trapping is a form of ATM fraud that involves the installation of a device inside or over the cash dispensing slot of an ATM. When a customer initiates a withdrawal, the machine appears to function normally, even producing the familiar whirring sound of cash being dispensed. However, the money never emerges. The customer, assuming the machine is malfunctioning, often walks away. Later, the perpetrator returns, removes the device, and collects the trapped cash. This method is particularly effective because it does not require access to the victim’s card data or PIN, making it harder to detect and easier to execute.

The origins of cash trapping can be traced back to England, where organized criminal groups began deploying these devices in urban and suburban areas. In one notable case, two men from Harrow, London—Sebastian Vizir and Lucian Martinica—were sentenced in 2022 for using cash trap devices across multiple counties including Berkshire, Hertfordshire, and Surrey. Their operation, which ran from December 2021 to February 2022, netted over £20,000 in stolen cash and caused an estimated £60,000 in damage to ATM machines. The criminals used claw-like implements inserted into the cash slot, which were often invisible to the average user. The simplicity and effectiveness of the method made it a preferred tactic among fraudsters.

The spread of cash trapping from England to other parts of Europe was swift. Reports from France, Germany, and Eastern Europe indicated similar techniques being used, often by transnational criminal networks. These groups exploited older ATM models lacking modern anti-fraud features, and targeted machines in high-traffic areas where users were less likely to linger or inspect the machine closely. By 2012, Financial Fraud Action UK reported over 2,400 cases of cash trapping in the first half of the year alone, with total losses from ATM fraud reaching £29.3 million.

The United States began seeing its first confirmed cases of cash trapping in the early 2020s. One of the earliest documented incidents occurred in Plano, Texas, where a Romanian national named Ionut Aurel Iova was arrested for installing a cash trap device on an ATM outside a bank on Preston Road. Surveillance footage captured Iova placing the device, and later returning to retrieve nearly $1,000 in trapped currency. His arrest revealed a broader criminal history, including warrants for theft and fraud in Maryland, Canada, and Hungary. The Plano Police Department described the crime as “simple yet sophisticated,” noting that the device was custom-made for the specific ATM model.

Since then, similar cases have emerged in other parts of the country, including California, Florida, and New York. In San Francisco, victims reported being scammed at Chase Bank ATMs where glue was used to disable the card reader, forcing users to use the “tap” function. This left their accounts open for further withdrawals, which scammers exploited by returning to the machine and draining funds. These incidents highlight the adaptability of cash trapping techniques and the increasing sophistication of perpetrators.

Law enforcement agencies across the United States have expressed growing concern over the rise of cash trapping. Officer Jerry Minton of the Plano Police Department, a veteran forgery investigator, stated that he had never encountered this type of fraud before. He emphasized the need for inter-agency cooperation and public vigilance, especially given the international nature of the suspects involved. The Department of Homeland Security has also become involved in cases where suspects had multiple international warrants, underscoring the global reach of these criminal networks.

PARPolice departments have begun issuing public warnings and prevention tips. These include inspecting ATMs for unusual attachments, covering the keypad when entering a PIN, and never walking away from a machine that fails to dispense cash. Instead, users are urged to immediately contact the bank or local law enforcement. Some banks have started installing sensors that detect obstructions in the cash slot, but many machines—especially those in convenience stores or standalone locations—remain vulnerable.

PARA

The deceptive nature of cash trapping makes it particularly dangerous. Unlike skimming, which often leaves behind digital traces, cash trapping relies on physical manipulation and the assumption that the machine is simply malfunctioning. This illusion causes many victims to delay reporting the incident, giving criminals ample time to retrieve the trapped money. In some cases, victims have even been denied fraud claims by banks, which argue that the transaction was completed successfully.

Public awareness is therefore critical. Many consumers are unfamiliar with the concept of cash trapping and may not recognize the signs. Educational campaigns by banks, law enforcement, and consumer advocacy groups are essential to inform the public about this threat. These campaigns should include visual examples of cash trap devices, instructions on how to inspect ATMs, and guidance on what to do if a transaction fails.

The elderly and technologically vulnerable populations are particularly at risk. In several cases, scammers have targeted seniors, exploiting their unfamiliarity with modern ATM functions. This has led to additional charges against perpetrators for the exploitation of vulnerable individuals. Community outreach programs and senior centers should incorporate ATM safety into their financial literacy efforts

The financial industry also bears responsibility. Banks must invest in upgrading ATM security features, including anti-skimming technology, real-time monitoring, and tamper detection systems. Staff should be trained to recognize signs of tampering and respond swiftly to customer complaints. Additionally, banks should review their fraud claim procedures to ensure that victims of cash trapping are not unfairly denied compensation.

From a policy perspective, lawmakers may need to consider regulations that mandate minimum security standards for ATMs, especially those located in high-risk areas. These could include requirements for surveillance cameras, regular maintenance checks, and public reporting mechanisms. Financial institutions should also be required to share data on ATM fraud with law enforcement to facilitate investigations and trend analysis.

The rise of cash trapping is a stark reminder that financial fraud is constantly evolving. As digital security improves, criminals adapt by exploiting physical vulnerabilities. The transatlantic spread of this crime—from England to the United States—demonstrates how quickly techniques can proliferate in the age of global connectivity. It also highlights the importance of international cooperation in combating financial crime.

In conclusion, ATM cash trapping represents a serious and growing threat to consumer safety and financial integrity. Originating in England and now firmly entrenched in the United States, this crime exploits the trust users place in everyday banking technology. Law enforcement agencies are increasingly alarmed, and the public must be educated to recognize and respond to this deceptive tactic. Through awareness, vigilance, and coordinated action, we can mitigate the impact of cash trapping and protect the financial well-being of our community.

At Misleading.com, our mission is to cut through confusion and expose the risks that often hide in plain sight. ATM security may seem routine, but the rise of cash trapping proves it’s anything but. When public safety meets public ignorance, it’s our job to make sure the truth gets seen. We want to here from you!