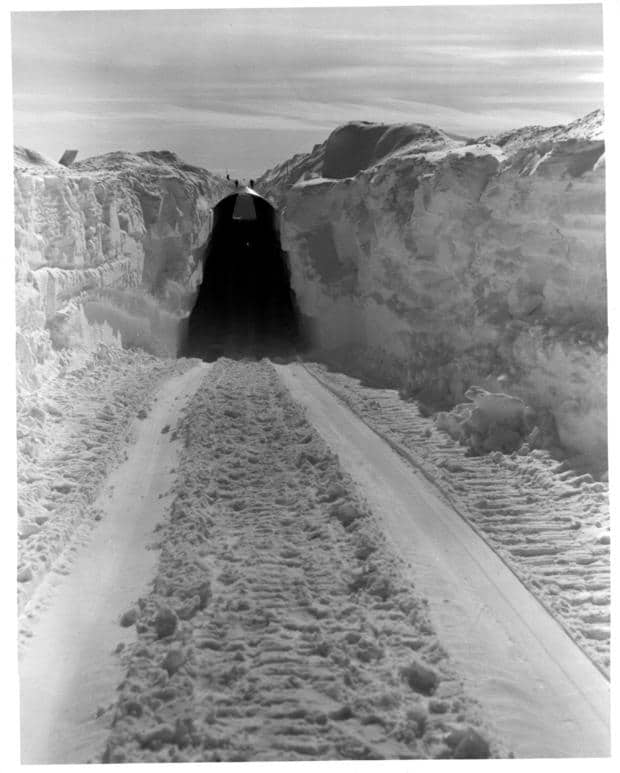

Getty Images

The price of gold soared to all-time highs this year, hitting a record $2,790 per ounce in October. People have been flocking to the precious metal for protection against inflation and global market swings.

Recently, though, gold prices have pulled back. But many investors still see this as an opportunity. In today’s economic climate, gold’s appeal lies in its role as a reliable store of value that can’t be printed or created at will.

As 2025 approaches, investors are watching gold closely. Economic shifts, political changes and global tensions could all impact its value in the coming months and experts see compelling evidence for different scenarios ahead.

See how much a gold investment could cost you here now.

Will gold prices increase in 2025?

Finance professionals see different possible paths for gold prices next year:

Yes, gold prices could tick back up in the new year

“With economic uncertainty, rising inflation and central banks maintaining interest in gold as a reserve seat, prices are likely to climb,” says Brandon Aversano, founder of The Alloy Market. When markets get shaky, he explains, investors turn to gold as a shield against volatility.

This flight to safety could gain momentum as U.S. policy shifts take shape. David Akrami, author of Gold and Silver Mastery, points to upcoming changes that might impact the dollar. These include new tariffs and pressure for lower interest rates. The stakes could rise even higher as some officials hint at moving away from the dollar as the world’s reserve currency. This would likely push gold prices up.

Adding to these economic factors, global tensions remain a wild card. Depending on what happens abroad, gold prices could spike or fall.

Get invested in gold before the price rises again.

But there’s always a chance it could hold steady or drop

Despite strong arguments for rising prices, gold may see headwinds in 2025. Recent developments on the global stage could cool the precious metal’s hot streak.

The economic picture could also shift against gold. “If central banks tighten up and push stronger monetary policies, we might see the U.S. dollar strengthen,” emphasizes Aversano. This could cause gold to become costly for foreign buyers and, thus, impact its demand. If inflation slows, he adds, “investors might focus [on] chasing higher returns with stocks or bonds.”

Gold investments to consider in 2025

Gold investments can help diversify your portfolio, regardless of where prices head in 2025. Many financial advisors suggest holding some gold as a hedge against inflation and market swings.

Akrami and Henry Yoshida, founder of Rocket Dollar, share three ways to invest in the precious metal next year:

Physical gold

If you want direct ownership, physical gold (e.g., gold bars and gold coins) offers complete control of your investment. While buying and selling comes with higher transaction costs, many investors value holding the actual metal. Some providers have gold IRA options with tax advantages through specialized depository partnerships.

Gold ETFs

Gold exchange-traded funds (ETFs) make it easy to buy and sell the precious metal through any brokerage account. Many are backed by real gold, giving you market exposure without storage hassles. “Preferably, investors should focus on gold-tracking ETFs to ensure pure exposure to the underlying asset,” Yoshida advises. Transaction costs stay low, making ETFs popular for new and experienced investors.

Gold mining stocks

Gold mining stocks come with company-specific risks. Unlike other gold investment options, their value depends on more than gold prices. “Not all mining stocks are the same, and some have better fundamentals than others,” Akrami cautions. Both experts recommend sticking to ETFs or physical gold unless you’re ready to research individual mining companies thoroughly.

The bottom line

Gold’s path in 2025 is uncertain, with global events and economic changes potentially pushing prices in either direction. Despite this, Aversano sees physical gold as a safe investment because its value doesn’t waver much with market changes. But he suggests ETFs as an accessible alternative for some investors depending on their goals.

Before gold investing, talk with a financial advisor about how gold fits your investment plan. They may help you start with a small allocation and choose an investment type that matches your risk appetite.