Former President Donald Trump and Vice President Kamala Harris do not agree on much. But they do agree on at least one policy position: both want to eliminate federal taxes on workers’ tips.

Trump first introduced his proposal to eliminate federal taxes on tips during a campaign rally in June. “We’re going to do that right away, first thing in office,” he said during a speech in Nevada, a state with one of the highest concentrations of tipped workers in the country (and, not incidentally, a crucial swing state in November).

One month later, also in Nevada, Harris joined Trump in supporting tax-free tips.

Donald Trump first introduced his proposal to eliminate federal taxes on tips during a campaign rally in June 2024. Shortly after, Harris joined Trump in supporting tax-free tips.

Getty Images

“It is my promise to everyone here: when I am president, we will continue to fight for working families, including raising the minimum wage and eliminating taxes on tips for service and hospitality workers,” Harris told a crowd in Las Vegas on Saturday, cribbing a populist proposal directly from her opponent.

Despite the bipartisan support, tax experts caution that the policy could lead to a host of complications. Ernie Tedeschi, director of economics at the Yale Budget Lab, a non-partisan policy research center, is among those sounding the alarm about the no-tax-on-tips idea, starting with the potential for tax avoidance among corporations or high-earning individuals who might use such a policy, intended for low- and middle-income workers, to their advantage.

“There is a potential risk that companies might reclassify other forms of income as tips to take advantage of the tax exemption, leading to fraud and income shifting. For example, financial services could reclassify bonuses or commissions as tips,” Tedeschi told Newsweek.

Details have been sparse from both campaigns, with only Harris floating the idea of limiting the tax exemption strictly to service and hospitality employees. Neither candidate’s team has clarified whether the exemption would apply to income taxes, payroll taxes, or both. The payroll tax funds Social Security and Medicare.

“The big question is why workers with similar income levels who perform similar types of work and are compensated via wages should not receive similar tax treatment as tipped workers,” said Garrett Wattson, senior policy analyst and modeling manager at the Tax Foundation, an international research think tank based in Washington, D.C.

“It is likely that many workers may head into tipped industries as those occupations become more attractive compared to occupations where income is subject to tax,” he added.

To the left, Vice President Kamala Harris walks on stage during a campaign rally at the University of Nevada in Las Vegas, Nevada, on August 10. To the right, President Donald Trump walks toward the stage to speak at a rally at Montana State University on August 9 in Bozeman, Montana.

RONDA CHURCHILL/AFP/Michael Ciaglo/Getty Images

The potential financial impact on the federal government is also a significant concern, according to Steve Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center, a nonpartisan think tank also based in Washington.

“While this policy might benefit a small group, it has significant national implications, especially for tax policy and government revenue,” the tax lawyer said.

The Yale Budget Lab estimates that there were about four million U.S. workers in tipped occupations — like waiters and beauticians — as of 2023, representing just 2.5% of all employees in the labor pool.

A national ban on taxing tips would benefit a Nevada restaurant server, who relies heavily on tips due to the state’s lower minimum wage, more than someone with the same job across the border in California, who earns a larger base wage and thus depends less on tips.

“If tips are exempt from taxation, employers might shift more of the compensation toward tips rather than wages, which could reduce government revenue and increase deficits unless other taxpayers cover the shortfall,” said Rosenthal.

“Policymakers would also need to address the potential for taxpayers to avoid taxes by reclassifying non-tipped income as tips,” added Wattson, from the Tax Foundation.

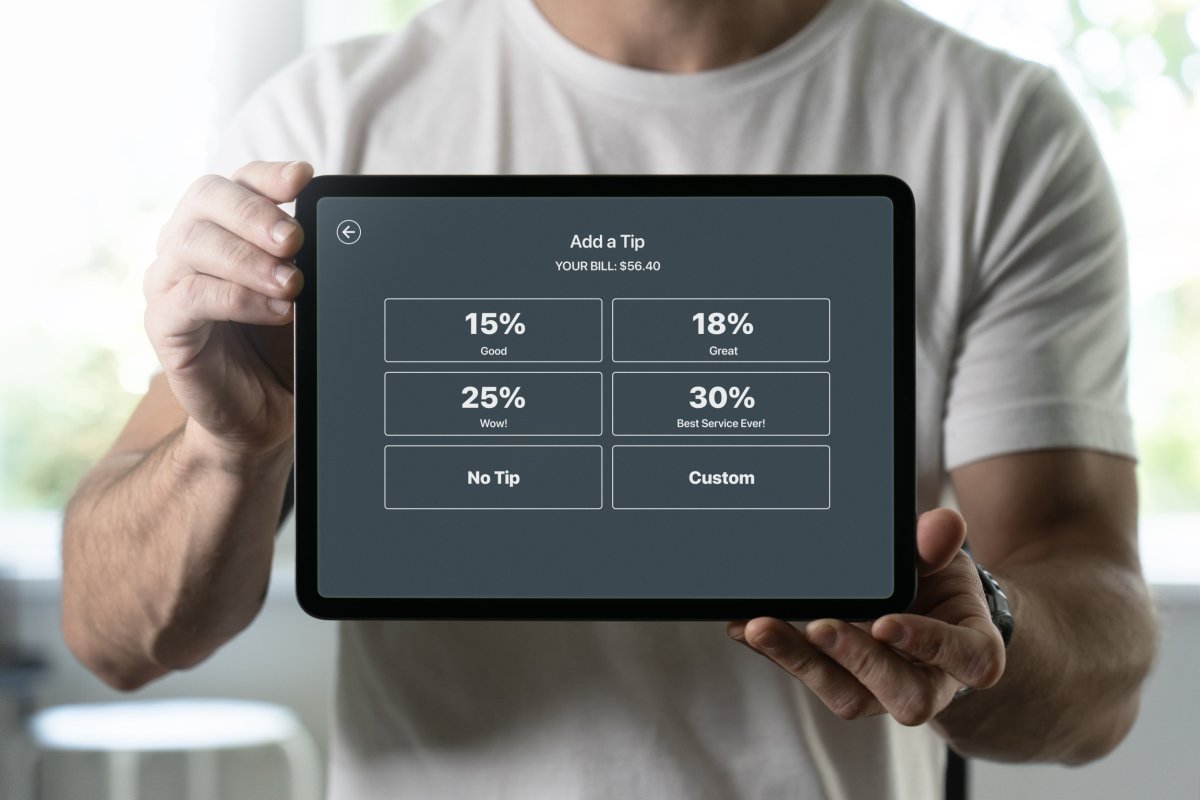

There is also concern that exempting tips could impact the broader tipping culture in the U.S., where more industries and workers might start relying on tips. This could change the dynamics of compensation across various sectors, potentially leading to more requests for tips in transactions where they are not currently expected — a scenario that has already been exacerbated by the proliferation of tip prompts on point-of-sale tablets.

“There are other ways to help these workers,” Tedeschi from Yale, said. He suggested raising the federal minimum wage, currently $7.25, and eliminating the federal tipped minimum wage as more effective ways to help low-income workers. (The federal minimum wage for tipped employees is currently $2.13, but employers have to make up the difference if an employee’s tipped wages don’t reach $7.25 per hour.)

The Budget Lab reported that the median weekly pay for tipped workers in 2023 was $538, compared with roughly $1,000 for non-tipped workers.

Getty Images

According to the Budget Lab, the median weekly pay for tipped workers in 2023 was $538, compared with roughly $1,000 for non-tipped workers. Tipped workers tend to be younger, with an average age of 31, and have lower incomes.

Changing federal tax policy on tips would also be costly. The Committee for a Responsible Federal Budget, a non-partisan group, estimates that exempting all tip income from federal income and payroll taxes would reduce revenue by $150 billion to $250 billion between 2026 and 2035. That amount could rise even higher if the policy has the effect of leading more people to declare tipped income.

Whether Trump’s and Harris’s shared vision for eliminating taxes on tips gains traction as a major economic policy flank remains to be seen. Despite warnings about the risks, the proposal remains popular among voters. A recent poll conducted exclusively for Newsweek by Redfield & Wilton Strategies shows that 67 percent of Americans believe tips given to service workers should not be taxed.

Millennials (70 percent) and Gen Xers (74 percent) were more likely to favor abolishing taxes on tips, while Gen Z (59 percent) was the least likely. Republicans (68 percent) were slightly more likely to agree with Trump’s idea than Democrats (65 percent).

Do you have a story Newsweek should be covering? Do you have any questions about this story? Contact LiveNews@newsweek.com